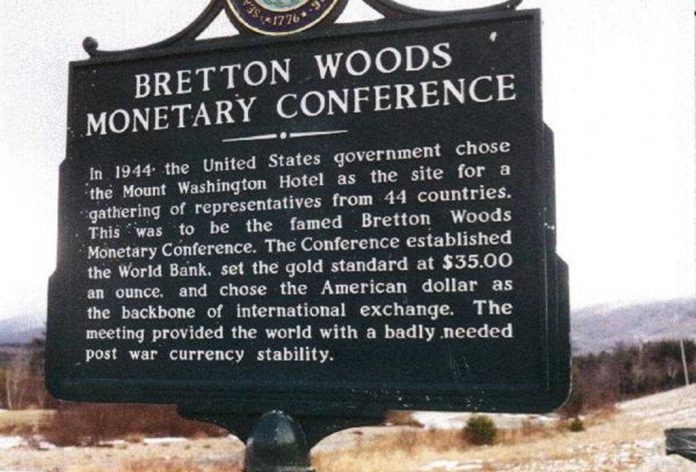

The Bretton Woods system was a fully negotiated monetary and exchange rate management system intended to govern monetary relations among independent states, in the wake of World War II.

Between 1944 and 1971, the Bretton Woods agreement fixed the value of 35 U.S. dollars to one troy ounce of gold. Other currencies were pegged to the dollar at fixed rates. The Bretton Woods system was abandoned in 1971, after what became widely known as the Nixon Shock – a series of economic measures taken by United States President Richard Nixon.

In the absence of an international system tying the dollar and other currencies to gold via fixed rates, a system of national fiat currencies with freely floating exchange rates has been used as a global standard ever since.

During the global financial crisis of 2008, policy makers have called for the implementation of a new international monetary order, often dubbed as “the Bretton Woods II”.

Bretton Woods cryptocurrency context

The Bretton Woods system is often mentioned by financial professionals whenever digital currencies are pitched against fiat currencies.

« Back to Wiki Homepage