New year, new questions. Or, in fact, the same question asked by different people, who are new to crypto: “What caused the recent bitcoin dip?” There’s only one answer to that, and you are probably not going to like it: “You did!” If you read about countries pushing strict regulations to “ban bitcoin”, went into panic mode and started to cash out, you are one of the culprits.

Here’s the thing: bitcoin has always been a thorn in the authorities’ side. It was designed to create a system beyond the manipulative hands of governments and central banks. It is supposed to serve as the catalyst that decentralizes financial services – a complete disruption of the status quo. Of course governments are not going to be able to stomach it. Of course central banks are going to try to put tight straps around it. Bitcoin and banks (both central and commercial) are and will inevitably always be philosophically opposed.

Instead of sending bitcoin on a rollercoaster ride every time a central bank has a go at it, perhaps we should remember what bitcoin is, what it is supposed to do, and how it has already proven its resilience over time. Bitcoin hasn’t gotten to where it is now thanks to governments and central banks. It got here in spite of them.

Look at China. China has a reputation for banning things on a whim. They’ve banned Google, Facebook, Twitter – and Xi Jinping only knows what else – out of fear and protectionism. They all seem to be doing just fine without China. The Chinese authorities hold a tight grip on what Hollywood movies are allowed in the country. They even banned moldy cheese. That’s right, they showed harmless stinky cheese who’s boss, only to lift the ban months later.

They have been flexing their muscles in the same way with bitcoin. The stakes are, of course, significantly and unquantifiably higher. But there’s a lesson to be learnt from China’s struggle to nip bitcoin in the bud: it can’t be done.

If you have been into crypto for a while now, chances are you already know about China’s on-again, off-again relationship with bitcoin. How they halted exchange transactions via direct deposits, then lifted the ban. How they ordered withdrawals to be suspended, only to scratch that months later, like nothing had happened. How every single time they issued a warning or a new set of guidelines, the media jumped to regurgitate the same sensationalist reports about a country-wide China bitcoin ban followed by a bitcoin crash. How every time rumors started to build up, the bitcoin price suffered losses, only to come back stronger. How bitcoin was tested time and time again, how we were tested along with it, and we always managed to land on our feet.

If you are relatively new to crypto though, a look back at some of China’s “bitcoin bans” might go a long way. We put together a timeline. It might not be comprehensive, but it is evocative enough to prove one very important point: countries can and will try to regulate bitcoin, but as long as people understand what bitcoin is, it will remain stateless and decentralized.

December 18, 2013: “China bans its financial institutions from handling bitcoin”

December 2013. IBT reported that The People’s Bank of China (PBOC) – China’s central bank, had banned banks and other financial service providers in the country from dealing with bitcoin.

The set of guidelines and new regulations put forward by PBOC were supposed to come into effect on January 31 of 2014. However, as soon as PBOC issued the first statement, BTC China announced it was suspending customer deposits.

Rumors started to float up, fear and panic started to settle within the community. It wasn’t long before, as the saying goes, panic bred panic, and bitcoin fell as low as $480, after having reached a (then) record high of $1,200 in early December.

By January 6 of 2014, however, bitcoin had bounced back to $1,017.12, per coinmarketcap historical data.

January 31, 2014: Media outlets realize that the so-called Chinese bitcoin ban had no effect on BTC value

The new guidelines issued by PBOC came into effect on January 31. The Chinese bitcoins did not get “locked behind a legal firewall” – like the panic-stricken community had expected, and BTC did not crash.

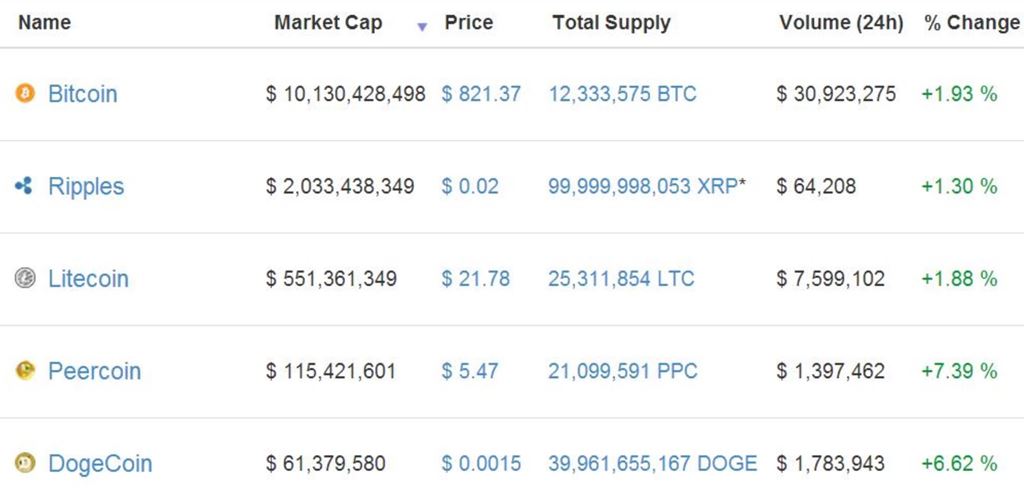

On the contrary, bitcoin did not budge one bit, it remained stable and most of the major cryptocurrencies of the time were trading in green territory.

On top of everything else, BTC China announced they were accepting deposits again, like nothing had happened.

March 21, 2014: BTC slips following fake report on new China bitcoin ban

A false news story published on a financial feed ran by Chinese microblogging site Sina brought the BTC price below $600. The report claimed that PBOC would halt all bitcoin trading in the country starting with April 15, 2014. BTC China reacted to the rumors, saying that exchanges received no documents mentioning a possible ban. PBOC declined to comment, and Sina retracted the fake news story.

“The People’s Bank of China declined to comment on this news, which indicates that this probably was a hoax indeed. So who did throw this message into the world? Maybe somebody who wanted to see a significant drop in Bitcoin prices so he or she could buy in cheap. If so, the strategy worked. Bitcoin is trading at about $570 now, being over $600 only a few hours ago. This kind of manipulation is not what Bitcoin was made for,” CCN wrote at the time.

April 25, 2014: The China ban rumor mill never stops turning, bitcoin takes another tumble

Beijing-based media group Caixin reported on a new crackdown by the PBOC. As a result, the bitcoin price dropped to around $450, after only having just recovered from the previous China scare.

“It almost feels as though there is some form of manipulation being instigated by the Chinese Bank officials, as it would seem that they still haven’t made up their minds,” Coinreport wrote at the time. “It is also important to note that Caixin has a reputation of spreading rumors hence this recent news should be taken with a grain of salt.”

The original Caixin article crystal balling the clampdown has since been removed.

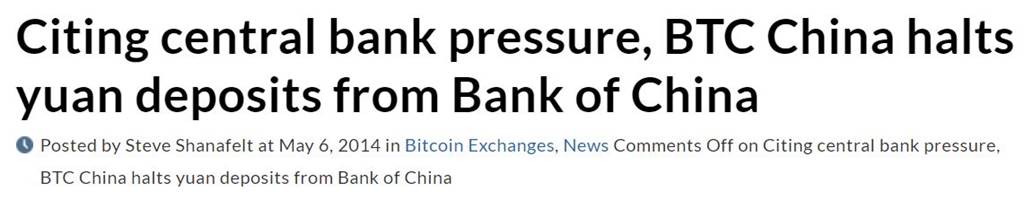

May 6, 2014: BTC China suspends yuan deposits, citing PBOC pressure

A letter thought to have been penned by the Bank of China got leaked in May of 2014. The letter announced the banning of any bitcoin trading activities using Bank of China accounts. As a result, BTC China halted CNY deposits from Bank of China.

China’s largest bank, the Industrial and Commercial Bank of China (ICBC), followed suit with a similar announcement of their own. Ten other banks – including the China Construction Bank and the Agricultural Bank of China – did the same, all citing PBOC pressure, although the PBOC itself had no comments on the matter.

Chinese exchanges OKCoin, Huobi, BTC China, BtcTrade, and CHBTC announced plans to move their accounts offshore.

“It’s worth noting that bitcoin and other virtual currencies are still perfectly legal in China, and that the PBoC has made several statements indicating that, as ‘collectable commodities’ crytocurrencies do not fall under its authority,” Bitcoinx wrote at the time.

Bitcoin didn’t react to all the commotion, remaining in $450 territory.

November 3, 2015: Chinese citizens can once again use direct bank deposits to trade bitcoin

On November 3, 2015, BTC China announced they were reinstating direct bank deposits. “All customers who have Chinese bank accounts will be able to make direct deposits through ATM transfers or online banking,” the announcement read.

The so-called “2013 China bitcoin ban” appeared to have been lifted overnight, without much explanation. Of course, bitcoin was never banned throughout 2013-2015 in China. It was never deemed illicit by Chinese authorities and Chinese citizens were still allowed to trade bitcoin, using vouchers or third party payment processors to deposit and withdraw money into/from cryptocurrency exchanges.

The bitcoin price started to regain its composure, and everyone went about their businesses unabated.

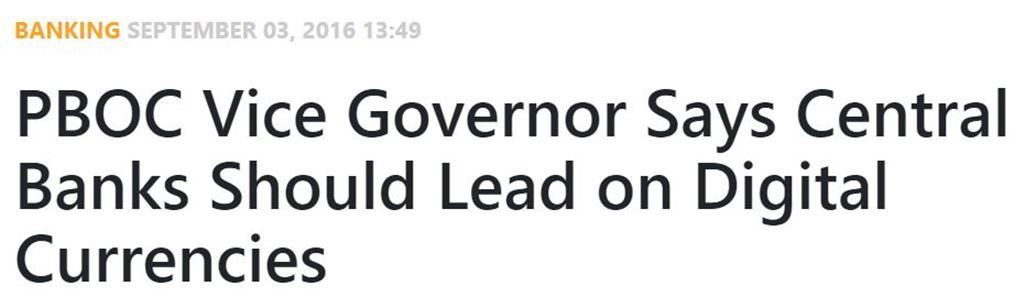

September 6, 2016: Supervision, not prohibition

Sharing his thoughts in the Bloomberg View column, PBOC vice-governor Fan Yfei stated that China should maintain financial stability through innovation and proper supervision [note: NOT prohibition] regarding the issuance and circulation of cryptocurrencies. He even went on to identify certain cryptocurrency strong points.

“With internet access increasing and encryption technology improving, the conditions are ripe for digital currencies, which can reduce operating costs, increase efficiency and enable a wide range of new applications,” CCN quoted the PBOC official.

January 9, 2017: PBOC alarm bells go off again, bitcoin takes another tumble

Bitcoin was neighboring $1,200 in early January 2017. As expected, PBOC issued a new set of vague warnings. Bitcoin dropped all the way down to $755, “amid concern China will tighten rules on the digital currency to curb capital outflows,” Bloomberg wrote at the time.

February 10, 2017: Chinese exchanges upgrade systems in compliance with new PBOC guidelines

It took bitcoin exactly one month to get back to where it had been when the PBOC issued the January 9 warnings. That, of course, made for the perfect time for PBOC to hold a closed-door meeting with several domestic exchanges, saying it would shut down exchanges that violate rules on foreign exchange management, money laundering, and payment and settlement.

Chinese exchanges announced they were upgrading their systems in line with new PBOC guidelines, adding that, in the meantime, all bitcoin withdrawals would be subjected to reviews.

The media once again blew everything out of proportion with countless sensationalist reports on a new China bitcoin ban. As a result, bitcoin dropped from $1,063 to $946. However, this time around, bitcoin bounced back to $1,061 only a week later.

February 23, 2017: China considers launching state-backed cryptocurrency

A digital currency task force put together by PBOC in 2014 was studying the prospects of issuing a cryptocurrency backed by the central bank. The news that China was planning its own cryptocurrency emerged first in 2016 and has since been regurgitated once every few months, with no further information added.

June 1, 2017: Chinese bitcoin exchanges resume withdrawals

After upgrading their “know your customer” and anti-money laundering systems, Chinese exchanges started to accept withdrawals once again, following a four-month “self-imposed” freeze.

According to Reuters, the decision to resume withdrawals was made after PBOC had signaled that it was not forbidden.

September 4, 2017: China bans initial coin offerings (ICOs)

In early September 2017, PBOC issued a notice banning “all types of currency issuance financing activities”. The document banned not only ICOs, but also the trading of any tokens created by an ICO. It also banned all financial institutions from getting involved in any ICO-related activities.

China’s Tron reacted with a statement, claiming its tokens were “safe”, as Tron’s team was a “supporting unit in the drafting of the Chinese 2017 regulation”. The clarification stoked confusion, as it was unclear whether ICOs would be completely shut down in the country or, on the contrary, permitted, so long as they were conducted in compliance with a new set of rules and guidelines established by the PBOC.

Bitcoin reacted by dropping from roughly $4,500 to just under $4,000, but pared the losses in only a matter of hours.

September 12, 2017: “China may ban Bitcoin trading, but the market doesn’t seem to care”

The media trumpeted another possible China bitcoin ban, citing China’s state-owned Caixin, the same Beijing-based media group with a questionable reputation which had been spreading rumors about Chinese authorities banning bitcoin since 2013.

Once the news hit the wire, bitcoin dropped from roughly $4,600 to $4,000. However, three days later, it started to recover and resumed its upward trajectory, leaving the media with a lot of unanswered questions. “So what’s happening? Was the report false? The answer is unclear at this point, but the market either no longer believes the report, or it simply doesn’t care,” Mashable wrote at the time.

September 15, 2017: “China orders all cryptocurrency exchanges to shut down”

The news that China was banning cryptocurrency exchanges was shouted from the rooftops by the same state-owned Caixin.

“While the news isn’t official yet, Caixin said it has seen the policy document and confirmed its authenticity with a source close to China’s regulators,” Mashable wrote at the time. PBOC refused to comment.

BTC China, ViaBTC, Huobi and OKCoin announced they would stop all trading operations by either September 30 or October 31.

Per Bloomberg, Chinese authorities had no plans to stop over-the-counter transactions. The ban would only apply to trading of cryptocurrencies on exchanges. So, while it could be interpreted as a de facto ban, it was not quite the “country-wide crypto ban” media outlets painted it to be. Moreover, it was speculated that PBOC was in fact planning to re-launch cryptocurrency exchanges in China under new rules. But once exchanges started to announce they were putting up the shutter, nothing else seemed to matter for the panicky community, and bitcoin started to plummet, dropping to $2,946 on September 15, down 40% from the July 2017 high of $4,952.

September 26, 2017: Bitcoin strikes back

“Bitcoin (BTC/USD) prices are grinding higher this week on renewed optimism that the blockchain will overcome China’s latest regulatory crackdown. Prices continued to trade comfortably north of $3,900 at the start of Tuesday trading. Prices shot up nearly 7% on Tuesday, according to Bitstamp. The BTC/USD was last seen trading at $3,909.00, where it was little changed from its previous close,” hacked.com wrote on September 26, 2017.

November 2, 2017: Exchanges stop all bitcoin trading in mainland China

In November of last year, PBOC pulled the plug on all domestic cryptocurrency exchanges. Bitcoin ownership and mining remained legal. Volumes on over-the-counter trading platforms exploded in China. Bitcoin trading volumes in Korea and Japan also increased dramatically, and none of the exchanges previously based in China ceased business altogether. They merely moved their servers abroad. BTC China, for instance, even went through a rebranding project, changing its name to BTCC.

“The only change is that for the moment the funds will move in and out of local currency via P2P transactions instead of via direct deposit. From a regulatory perspective this is an inferior solution because it’s much harder to prevent money laundering,” Scott Freeman, CEO of C2CX, explained.

On November 2, 2017, when the last cryptocurrency exchange still standing in China put up the shutter, bitcoin was on the rise, changing hands at a high of $7,367.

November 14, 2017: Rumors that China might ban bitcoin mining start to build up

Citing Tencent Finance, CCN reported that China was extending its bitcoin ban to mining operations. The rumors got refuted the same day. Bitcoin was trading in $6,500 territory. One month later, in December, bitcoin skyrocketed all the way up to $20,000, in spite of the constant China pressure.

January 3, 2018: PBOC puts rumors to rest

New year, new rumors. In early January, PBOC was said to have held a closed-door meeting to discuss a domestic shutdown of all bitcoin mining activities in China. On January 3, PBOC denied hosting any meetings, further clarifying that China did not intend to ban bitcoin mining, but merely to “withdraw preferential benefits such as tax deductions and cheap electricity supplies available to bitcoin mining companies”.

“This means the government’s current stance on bitcoin mining is to neither encourage nor hamper such activities,” Coindesk explained.

Nevertheless, some Chinese mining companies started to look at moving their operations to Canada or Russia.

January 15, 2018: China takes the crackdown one step further

After the exchange ban of 2017, Chinese citizens moved their trading operations to alternative apps and platforms. Unsurprisingly, the PBOC announced it would be targeting “online platforms and mobile apps that offer exchange-like services”.

Interestingly, peer-to-peer cryptocurrency trades remain legal in the country.

Following back-to-back rumors about tight regulation coming from South Korea and China, bitcoin and the entire cryptocurrency market have a shaky start to the year.